How to Track Business Expenses: A Comprehensive Guide for Businesses

Financial Intelligence

Premium financial content

Introduction: Why Effective Expense Tracking is Crucial for Your Business

Section 1: The Fundamentals of Business Expense Tracking

1.1 What Qualifies as a Business Expense?

1.2 Why Track Business Expenses?

1.2.1 Tax Benefits and Deductions

1.2.2 Financial Health and Decision Making

1.2.3 Budgeting and Forecasting

Section 2: Essential Steps to Set Up Your Expense Tracking System

2.1 Separate Business and Personal Finances

2.2 Choose Your Tracking Method

2.2.1 Manual Tracking (Spreadsheets)

2.2.2 Automated Tracking (Software and Apps)

2.3 Categorize Your Expenses

2.4 Keep Meticulous Records (Receipts and Documentation)

2.5 Record Expenses Regularly

Section 3: Popular Tools and Software for Expense Tracking

3.1 Accounting Software (e.g., QuickBooks, FreshBooks)

3.2 Dedicated Expense Tracking Apps (e.g., Expensify, Zoho Expense)

3.3 Spreadsheet Templates (Excel, Google Sheets)

3.4 Other Solutions (e.g., Bank Feeds, Credit Card Integrations)

Section 4: Best Practices for Optimized Expense Tracking

4.1 Establish Clear Expense Policies

4.2 Digitize and Automate Whenever Possible

4.3 Reconcile Regularly

4.4 Conduct Regular Audits

4.5 Leverage AI for Deeper Insights (Connecting to Finni AI)

Section 5: Common Challenges and How to Overcome Them

5.1 Lost Receipts

5.2 Incorrect Categorization

5.3 Time Consumption

Conclusion: Mastering Your Business Finances

References

In the dynamic world of business, managing finances effectively is not just a good practice—it's a fundamental necessity for survival and growth. At the heart of sound financial management lies the meticulous process of tracking business expenses. This isn't merely about recording what you spend; it's about gaining profound insights into your operational costs, optimizing your financial health, and ensuring compliance with tax regulations. For businesses of all sizes, from burgeoning startups to established enterprises, understanding where every dollar goes is paramount. This comprehensive guide will delve into the intricacies of business expense tracking, offering practical strategies, highlighting essential tools, and outlining best practices to transform your financial management from a daunting task into a streamlined, insightful process. By the end of this article, you will have a clear roadmap to establish an authority-building system for tracking your business expenses, empowering you to make informed decisions and drive your business forward.

Section 1: The Fundamentals of Business Expense Tracking

Before diving into the 'how-to,' it's crucial to establish a clear understanding of what constitutes a business expense and why its diligent tracking is non-negotiable for any successful venture. This foundational knowledge will serve as the bedrock for building a robust and efficient expense management system.

1.1 What Qualifies as a Business Expense?

At its core, a business expense is any cost incurred in the course of operating your business that is both ordinary and necessary. The Internal Revenue Service (IRS) defines an ordinary expense as one that is common and accepted in your industry, and a necessary expense as one that is helpful and appropriate for your business [1]. It's important to note that an expense doesn't have to be indispensable to be considered necessary. This broad definition encompasses a wide array of expenditures, from the obvious to the less apparent.

Common categories of business expenses include, but are not limited to:

•Operating Costs: Rent, utilities, office supplies, internet, phone services.

•Salaries and Wages: Employee compensation, benefits, payroll taxes.

•Marketing and Advertising: Website development, online ads, print materials, public relations.

•Travel and Entertainment: Business trips, client meals (with specific limitations), conferences.

•Professional Services: Legal fees, accounting services, consulting fees.

•Insurance: Business liability, property, health insurance for employees.

•Equipment and Technology: Computers, software subscriptions, machinery, vehicles used for business.

•Cost of Goods Sold (COGS): Direct costs associated with producing the goods or services your business sells.

Distinguishing between business and personal expenses is a critical first step. Commingling funds can lead to significant complications during tax season and obscure your true financial picture. Therefore, maintaining a clear separation is not just a recommendation but a necessity for accurate tracking and compliance.

1.2 Why Track Business Expenses?

The reasons for diligently tracking business expenses extend far beyond mere record-keeping. It's a strategic activity that underpins several vital aspects of your business's financial health and operational efficiency.

1.2.1 Tax Benefits and Deductions

One of the most immediate and tangible benefits of meticulous expense tracking is maximizing tax deductions. The IRS allows businesses to deduct ordinary and necessary expenses from their gross income, thereby reducing their taxable income and, consequently, their tax liability. Without proper documentation and categorization, businesses risk missing out on valuable deductions, leading to higher tax payments than necessary. For instance, every dollar of deductible expense can reduce your tax burden, directly impacting your bottom line. This is particularly crucial for small businesses and startups where every saving counts.

1.2.2 Financial Health and Decision Making

Accurate expense tracking provides a real-time snapshot of your business's financial health. By understanding your spending patterns, you can identify areas of overspending, pinpoint inefficiencies, and allocate resources more strategically. This data is invaluable for making informed business decisions, such as:

•Pricing Strategies: Understanding your true costs helps in setting competitive yet profitable prices for your products or services.

•Investment Opportunities: Identifying surplus funds or areas where costs can be cut allows for reinvestment into growth opportunities.

•Operational Efficiency: Detailed expense reports can highlight redundant services or underutilized assets, prompting operational adjustments.

Without this clarity, businesses operate in the dark, making decisions based on assumptions rather than concrete financial data, which can lead to suboptimal outcomes.

1.2.3 Budgeting and Forecasting

Historical expense data is the foundation for effective budgeting and financial forecasting. By analyzing past expenditures, businesses can create realistic budgets, set achievable financial goals, and predict future cash flow with greater accuracy. This foresight is essential for:

•Resource Allocation: Ensuring that sufficient funds are available for critical operations and strategic initiatives.

•Contingency Planning: Building reserves for unexpected expenses or economic downturns.

•Growth Planning: Projecting future expenses associated with expansion, such as hiring new staff or acquiring new assets.

In essence, tracking business expenses transforms raw financial data into actionable intelligence, enabling proactive financial management rather than reactive damage control. It moves your business from merely surviving to strategically thriving.

Section 2: Essential Steps to Set Up Your Expense Tracking System

Establishing an effective system for tracking business expenses doesn't have to be an overwhelming task. It begins with a few fundamental steps that, once implemented, will lay a solid groundwork for accurate record-keeping and insightful financial analysis. These steps are crucial regardless of the size or nature of your business.

2.1 Separate Business and Personal Finances

This is arguably the most critical first step in effective business expense tracking. Commingling personal and business funds is a common pitfall for many small business owners and freelancers, but it can lead to significant headaches, especially during tax season or an audit. The IRS views a clear separation of finances as a strong indicator of a legitimate business. [2]

How to achieve separation:

•Open a Dedicated Business Bank Account: As soon as you start your business, open a separate checking and savings account solely for business transactions. This creates a clear audit trail and simplifies reconciliation.

•Obtain a Business Credit Card: Use a business credit card for all business-related purchases. This further segregates expenses and can offer additional benefits like rewards or detailed spending reports.

•Avoid Using Personal Accounts for Business: Even for small purchases, resist the temptation to use personal debit or credit cards. If an occasional personal expense is inadvertently paid from a business account (or vice-versa), ensure it's immediately recorded and reconciled.

By maintaining distinct financial identities for your business and personal life, you not only simplify expense tracking but also protect your personal assets in case of business liabilities.

2.2 Choose Your Tracking Method

Once your finances are separated, the next step is to select a method for recording your expenses. The best method for you will depend on the volume of your transactions, your comfort level with technology, and your budget. There are generally two broad categories:

2.2.1 Manual Tracking (Spreadsheets)

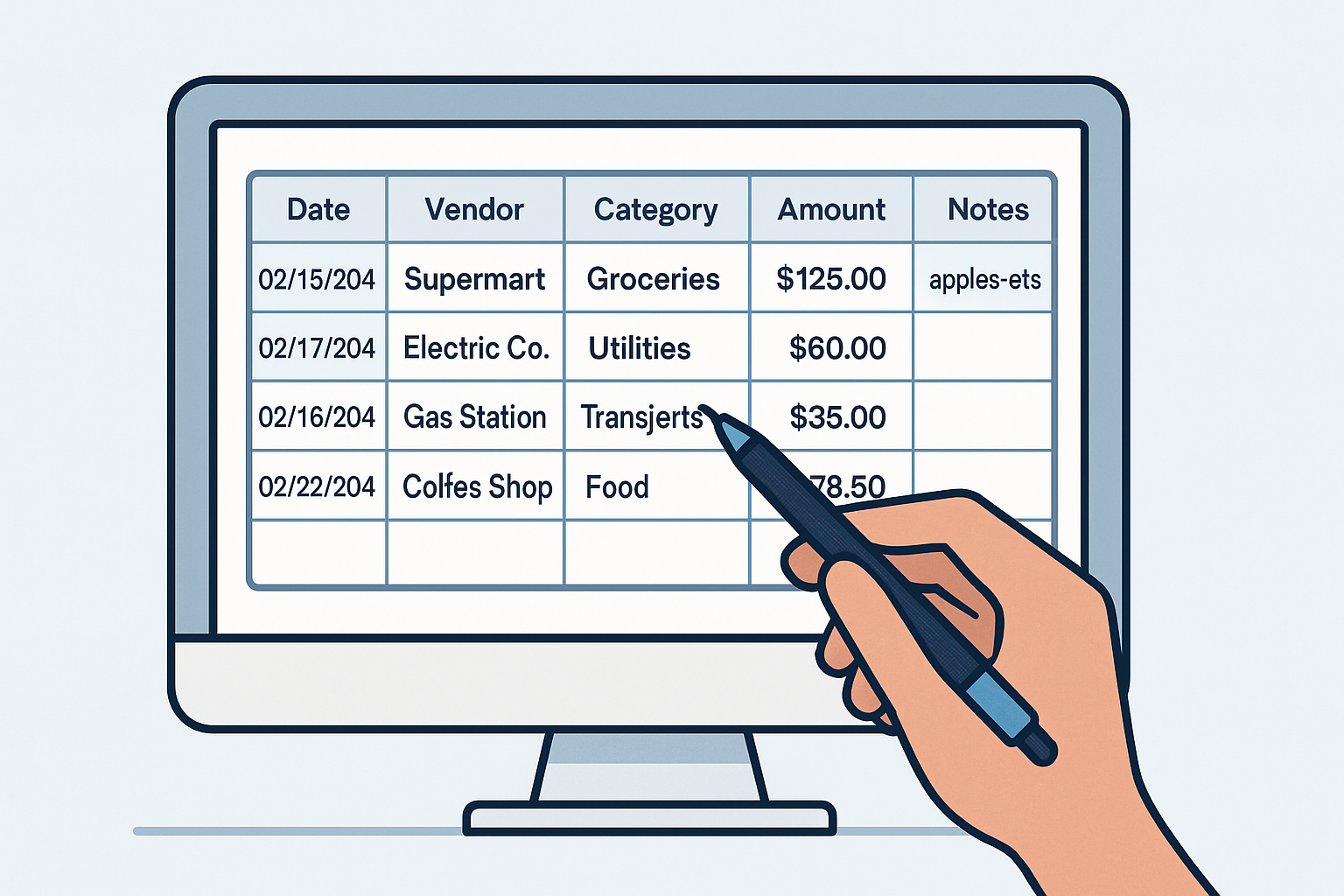

For very small businesses, freelancers, or those just starting out with a low volume of transactions, manual tracking using spreadsheets (like Microsoft Excel or Google Sheets) can be a cost-effective and straightforward option. This method provides complete control over your data and can be customized to your specific needs.

Advantages:

•Cost-Effective: Often free, as spreadsheet software is widely available.

•Customizable: You can design your spreadsheet to include exactly the columns and categories you need.

•Direct Control: You have full oversight of every entry.

Disadvantages:

•Time-Consuming: Requires manual data entry for every transaction, which can become tedious as your business grows.

•Prone to Errors: Manual entry increases the risk of typos or miscategorizations.

•Limited Features: Lacks advanced features like automated bank feeds, receipt scanning, or detailed reporting found in dedicated software.

Best Practices for Spreadsheets:

•Consistent Format: Use a consistent layout for dates, descriptions, categories, and amounts.

•Regular Updates: Commit to updating your spreadsheet daily or weekly to avoid a backlog.

•Backup Your Data: Regularly save copies of your spreadsheet to a cloud service or external drive.

2.2.2 Automated Tracking (Software and Apps)

As your business scales, or if you prefer a more efficient and less error-prone approach, automated expense tracking solutions become indispensable. These typically involve dedicated accounting software or specialized expense management applications.

Advantages:

•Time-Saving: Automates data entry through bank feeds, credit card integrations, and receipt scanning.

•Accuracy: Reduces human error and ensures consistent categorization.

•Advanced Features: Offers robust reporting, budgeting tools, tax preparation features, and integration with other business systems.

•Accessibility: Cloud-based solutions allow access from anywhere, on any device.

Disadvantages:

•Cost: Most comprehensive solutions come with a monthly or annual subscription fee.

•Learning Curve: May require some time to learn the software and set up integrations.

We will explore specific tools and software in more detail in Section 3.

2.3 Categorize Your Expenses

Proper categorization is crucial for understanding your spending, preparing for taxes, and generating meaningful financial reports. The categories you choose should be logical and align with common accounting practices and tax requirements. While you can create custom categories, it's often beneficial to start with standard ones.

Common Expense Categories:

•Advertising & Marketing: Website costs, social media ads, print ads, promotional materials.

•Bank Fees: Monthly service charges, transaction fees.

•Business Travel: Airfare, lodging, car rentals, mileage (if using personal vehicle).

•Contract Labor: Payments to independent contractors or freelancers.

•Dues & Subscriptions: Professional memberships, software subscriptions, industry publications.

•Insurance: Business liability, property, health insurance premiums.

•Legal & Professional Fees: Attorney fees, accountant fees, consulting fees.

•Office Expenses: Supplies, postage, small equipment.

•Rent or Lease: Office space, equipment leases.

•Repairs & Maintenance: Upkeep of property or equipment.

•Utilities: Electricity, gas, water, internet.

Tips for Categorization:

•Consistency is Key: Once you establish a category, stick to it for similar expenses.

•Be Specific: Avoid overly broad categories like "Miscellaneous." If an expense doesn't fit neatly, consider creating a new, more specific category.

•Consult Your Accountant: Your accountant can provide guidance on the best categories for your specific business and industry, especially concerning tax deductibility.

2.4 Keep Meticulous Records (Receipts and Documentation)

Regardless of your tracking method, maintaining thorough records is non-negotiable. Receipts, invoices, and other supporting documentation are your proof of expenditure and are essential for tax purposes and audits. The IRS requires businesses to keep records that support income, deductions, and credits shown on tax returns. [3]

What to keep:

•Receipts: For every purchase, obtain a receipt. This includes paper receipts, email confirmations, and digital invoices.

•Invoices: For services rendered or goods purchased on credit, keep detailed invoices.

•Bank and Credit Card Statements: These provide an overview of your transactions and can be used for reconciliation.

•Contracts and Agreements: For recurring services or significant purchases, keep copies of contracts.

How to store records:

•Digital Storage: The most efficient method is to digitize all your receipts. Take photos of paper receipts using your smartphone or a scanner. Many expense tracking apps offer built-in receipt scanning features.

•Cloud Storage: Store digital copies in a secure cloud service (e.g., Google Drive, Dropbox, OneDrive) for easy access and backup.

•Organized Folders: Create a logical folder structure (e.g., by month, by category, by vendor) to quickly locate specific documents.

•Physical Backup (Optional): While digital is preferred, some businesses may choose to keep physical copies of critical receipts for a certain period.

Remember, the goal is to have a clear, verifiable record for every business expense. This not only simplifies tax preparation but also provides a robust defense in case of an audit.

2.5 Record Expenses Regularly

Procrastination is the enemy of effective expense tracking. Waiting until the end of the month, quarter, or even year to record expenses can lead to forgotten transactions, lost receipts, and a significant time crunch. Regularity is key to accuracy and efficiency.

Tips for Regular Recording:

•Daily or Weekly Habit: Make it a habit to record expenses daily or at least weekly. This keeps the task manageable and ensures details are fresh in your mind.

•Set Reminders: Use calendar reminders or integrate with your accounting software's notification system.

•Process Receipts Immediately: As soon as you incur an expense, capture the receipt and enter the details into your tracking system.

•Reconcile Bank Statements: Regularly reconcile your bank and credit card statements with your recorded expenses. This helps catch discrepancies and ensures all transactions are accounted for.

By integrating expense recording into your regular business routine, you transform it from a burdensome chore into a seamless part of your financial management, providing continuous clarity on your spending and enabling proactive financial decisions.

Section 3: Popular Tools and Software for Expense Tracking

In today's digital age, businesses have a plethora of tools and software at their disposal to streamline expense tracking. The right tool can significantly reduce manual effort, improve accuracy, and provide deeper insights into your financial data. Choosing the best solution depends on your business size, complexity, budget, and specific needs. Here, we explore some of the most popular categories and examples.

3.1 Accounting Software (e.g., QuickBooks, FreshBooks)

Full-fledged accounting software solutions are designed to manage all aspects of a business's financial operations, including expense tracking, invoicing, payroll, and financial reporting. They are particularly well-suited for growing businesses that require a comprehensive financial management system.

QuickBooks Online:

QuickBooks is arguably the most widely recognized accounting software for small and medium-sized businesses. It offers robust expense tracking features, allowing users to connect bank accounts and credit cards for automatic transaction imports. Expenses can be categorized, and receipts can be attached digitally. QuickBooks also provides detailed reports, making tax preparation significantly easier.

•Key Features: Automated bank feeds, receipt capture, expense categorization, invoicing, payroll integration, comprehensive financial reporting.

•Pros: Industry standard, extensive features, good for growing businesses, integrates with many other business tools.

•Cons: Can be more expensive than dedicated expense trackers, may have a steeper learning curve for beginners.

FreshBooks:

FreshBooks is popular among freelancers and service-based businesses due to its user-friendly interface and strong invoicing capabilities. It also offers solid expense tracking, allowing users to import expenses, categorize them, and attach receipts. Its mobile app is highly rated for on-the-go expense management.

•Key Features: Automated expense import, receipt capture, project expense tracking, invoicing, time tracking.

•Pros: User-friendly, excellent for invoicing, good mobile app, strong customer support.

•Cons: May not be as robust for inventory management or complex accounting needs as QuickBooks.

3.2 Dedicated Expense Tracking Apps (e.g., Expensify, Zoho Expense)

For businesses primarily focused on simplifying expense reporting and reimbursement, dedicated expense tracking apps offer specialized features. These tools are often used by employees to submit expenses, which are then approved and processed by the finance department.

Expensify is renowned for its SmartScan technology, which allows users to simply take a photo of a receipt, and the app automatically extracts the relevant data (vendor, date, amount, etc.). It automates expense reports, simplifies approvals, and facilitates quick reimbursements. [4]

•Key Features: SmartScan (OCR receipt scanning), automated expense reports, corporate card reconciliation, policy enforcement, direct reimbursement.

•Pros: Highly automated, excellent for receipt management, streamlines reimbursement process, widely adopted.

•Cons: Can be more expensive for larger teams, some advanced features require higher-tier plans.

Part of the broader Zoho Suite, Zoho Expense is a comprehensive expense reporting and management solution. It offers features like receipt scanning, mileage tracking, and customizable approval workflows. It integrates seamlessly with other Zoho applications, making it a good choice for businesses already using Zoho products.

•Key Features: Receipt scanning, mileage tracking, multi-currency support, customizable approval workflows, integration with Zoho Books and other Zoho apps.

•Pros: Affordable, good for small to medium-sized businesses, strong integration with Zoho ecosystem, user-friendly interface.

•Cons: May require additional Zoho subscriptions for full accounting functionality.

3.3 Spreadsheet Templates (Excel, Google Sheets)

As mentioned in Section 2, spreadsheets remain a viable option for basic expense tracking, especially for individuals or very small businesses with limited budgets. Many free templates are available online, offering a structured way to record and categorize expenses.

Microsoft Excel Templates:

Microsoft offers a variety of free business expense templates that can be downloaded and customized. These templates typically include columns for date, vendor, description, category, amount, and notes. They often come with built-in formulas for summing expenses by category or month.

•Key Features: Customizable columns, basic formulas for calculations, manual data entry.

•Pros: Free, widely accessible, familiar interface for many users, full control over data.

•Cons: Requires significant manual effort, prone to human error, lacks automation and advanced reporting.

Google Sheets Templates:

Similar to Excel, Google Sheets provides free, cloud-based spreadsheet functionality with collaborative features. This makes it an attractive option for small teams or businesses that need to share expense data in real-time. Templates for expense tracking are readily available.

•Key Features: Cloud-based, real-time collaboration, basic formulas, manual data entry.

•Pros: Free, accessible from any device with internet, easy sharing and collaboration.

•Cons: Same limitations as Excel regarding automation and advanced features.

3.4 Other Solutions (e.g., Bank Feeds, Credit Card Integrations)

Beyond dedicated software, several other methods and integrations can significantly aid in expense tracking:

•Direct Bank and Credit Card Feeds: Many accounting software and expense tracking apps allow direct integration with your business bank accounts and credit cards. This automates the import of transactions, reducing manual data entry and ensuring accuracy. It's a cornerstone of modern expense management.

•Virtual Credit Cards: Some financial platforms offer virtual credit cards that can be issued for specific vendors or spending limits. These can help categorize expenses at the point of purchase and provide real-time spending insights.

•Payroll Software Integration: If you use separate payroll software, ensure it integrates with your accounting system. This streamlines the recording of salary, wages, and related taxes as business expenses.

•Mileage Tracking Apps: For businesses with significant travel, dedicated mileage tracking apps (e.g., Everlance, MileIQ) can automatically log distances, making it easier to claim mileage deductions. These often integrate with broader expense management systems.

Choosing the right combination of tools is crucial. For most growing businesses, a dedicated accounting software or a robust expense tracking app integrated with bank feeds will provide the best balance of automation, accuracy, and insightful reporting. Manual methods are best reserved for the very early stages or for supplementary record-keeping. The key is to select a system that simplifies the process, reduces errors, and provides the financial clarity needed for informed decision-making.

Section 4: Best Practices for Optimized Expense Tracking

Implementing the right tools is only half the battle; establishing robust best practices is equally vital for an optimized expense tracking system. These practices ensure accuracy, compliance, and provide actionable insights that drive financial efficiency and strategic growth.

4.1 Establish Clear Expense Policies

For any business with multiple employees incurring expenses, a clear, well-communicated expense policy is paramount. This document outlines what expenses are reimbursable, what documentation is required, and the procedures for submitting expense reports. A comprehensive policy minimizes confusion, prevents unauthorized spending, and streamlines the reimbursement process.

Key elements of an expense policy:

•Definition of Reimbursable Expenses: Clearly list categories of expenses that are eligible for reimbursement (e.g., travel, meals, office supplies, software subscriptions).

•Non-Reimbursable Expenses: Explicitly state what will not be reimbursed (e.g., personal items, luxury travel upgrades).

•Spending Limits: Set clear limits for various expense categories (e.g., per diem for meals, maximum hotel rates).

•Documentation Requirements: Specify the type of documentation needed for each expense (e.g., original receipts, invoices, proof of payment) and the information that must be included (vendor, date, amount, purpose).

•Submission Procedures: Detail how and when expense reports should be submitted (e.g., via a specific app, weekly, monthly).

•Approval Process: Outline the hierarchy and steps for expense report approval.

•Consequences of Non-Compliance: Clearly state the repercussions for violating the expense policy.

Regularly review and update your expense policy to reflect changes in business operations, tax laws, or company culture. Ensure all employees are trained on the policy and have easy access to it.

4.2 Digitize and Automate Whenever Possible

The move from paper-based to digital expense management is not just a trend; it's a necessity for efficiency and accuracy. Automation, powered by technology, can significantly reduce the time and effort spent on tracking expenses.

•Embrace Digital Receipts: Encourage employees to request and retain digital receipts. For paper receipts, utilize mobile apps with OCR (Optical Character Recognition) technology to scan and extract data automatically. This eliminates manual data entry and reduces the risk of lost receipts.

•Automated Bank and Credit Card Feeds: Connect your business bank accounts and credit cards directly to your accounting or expense management software. This allows transactions to be automatically imported and often categorized, saving hours of manual reconciliation.

•Automated Expense Categorization: Many modern tools use AI and machine learning to learn your spending patterns and automatically categorize expenses. While initial review may be needed, this significantly speeds up the process over time.

•Automated Workflows: Set up automated approval workflows for expense reports, ensuring that reports are routed to the correct managers for review and approval, and then seamlessly integrated into your accounting system for reimbursement.

Automation not only saves time but also provides real-time visibility into spending, allowing for quicker identification of anomalies and better cash flow management.

4.3 Reconcile Regularly

Reconciliation is the process of comparing your recorded expenses with your bank and credit card statements to ensure that all transactions are accounted for and that there are no discrepancies. This practice is crucial for maintaining accurate financial records and detecting errors or fraud.

•Daily or Weekly Review: For high-volume businesses, a daily or weekly review of transactions against receipts can prevent small errors from becoming large problems. For smaller businesses, a weekly or bi-weekly reconciliation might suffice.

•Monthly Bank Reconciliation: At the end of each month, perform a thorough reconciliation of all business bank accounts and credit card statements with your expense records. This ensures that your books match the bank's records.

•Investigate Discrepancies: Any discrepancies, no matter how small, should be immediately investigated. This could indicate a missing receipt, an incorrect entry, or even fraudulent activity.

Regular reconciliation provides peace of mind, ensures the accuracy of your financial statements, and simplifies tax preparation by catching errors early.

4.4 Conduct Regular Audits

Beyond regular reconciliation, periodic internal audits of your expense tracking system are a best practice. These audits help ensure compliance with company policies, identify areas for process improvement, and verify the integrity of your financial data.

•Random Spot Checks: Periodically select a random sample of expense reports and cross-reference them with original receipts and company policies.

•Review Policy Compliance: Assess whether employees are adhering to the established expense policies and identify any common areas of non-compliance that might require further training or policy adjustments.

•Analyze Spending Patterns: Look for unusual spending patterns, spikes in certain expense categories, or deviations from budget. This can uncover inefficiencies or potential misuse of funds.

•Seek External Audits: For larger businesses, consider engaging an external auditor periodically to provide an independent review of your expense management processes and controls.

Regular audits act as a control mechanism, reinforcing the importance of accurate expense tracking and helping to maintain financial discipline across the organization.

4.5 Leverage AI for Deeper Insights (Connecting to Finni AI)

The future of expense tracking lies in leveraging artificial intelligence (AI) to move beyond mere record-keeping to proactive financial intelligence. AI-powered platforms, like Finni AI, can analyze vast amounts of financial data, identify patterns, and provide actionable insights that traditional methods cannot.

•Automated Categorization and Anomaly Detection: AI algorithms can learn from your historical spending data to categorize expenses with high accuracy, even for complex transactions. More importantly, AI can detect anomalies—unusual spending patterns, duplicate charges, or forgotten subscriptions—that might otherwise go unnoticed. For example, Finni AI's ability to flag recurring charges you don't use can save businesses significant amounts annually.

•Predictive Analytics: AI can analyze past spending trends to forecast future expenses with greater precision, aiding in more accurate budgeting and financial planning. This allows businesses to anticipate cash flow needs and make proactive adjustments.

•Personalized Recommendations: Beyond just tracking, AI can offer personalized recommendations for cost savings. This could include suggesting cheaper alternatives for recurring services, negotiating better rates with vendors, or identifying areas where spending can be reduced without impacting operations. Finni AI's capability to suggest switching from expensive food delivery to meal prep, saving a user $120/month, exemplifies this personalized, actionable insight.

•Real-time Insights and Alerts: AI-driven dashboards provide real-time visibility into your financial health, offering instant alerts on unusual spending or potential savings opportunities. This immediate feedback loop empowers businesses to react quickly to financial changes.

•Subscription Management: A significant challenge for many businesses is tracking and managing numerous software subscriptions and recurring services. AI can automatically identify all subscriptions, alert you to upcoming renewals, and even help cancel unused ones, preventing unnecessary expenditures.

Integrating an AI financial assistant like Finni AI into your expense tracking strategy transforms it from a reactive process into a proactive, intelligent system. It's like having a dedicated financial detective and advisor working 24/7 to optimize your spending and maximize your savings. This shift from data collection to data intelligence is where true financial mastery begins.

Section 5: Common Challenges and How to Overcome Them

Even with the best intentions and tools, businesses often encounter common challenges in expense tracking. Recognizing these hurdles and implementing strategies to overcome them is crucial for maintaining an efficient and accurate system.

5.1 Lost Receipts

Lost or misplaced receipts are a perennial problem for businesses, leading to missed deductions and incomplete records. This challenge is particularly acute for employees who are frequently on the go.

How to overcome:

•Implement a "Capture Immediately" Policy: Encourage or mandate that employees capture receipts digitally at the point of purchase. Mobile apps for expense tracking often have built-in camera functions that allow for instant photo capture and upload.

•Utilize Digital Receipt Features: Many vendors now offer digital receipts via email. Encourage employees to opt for these whenever possible and ensure they are forwarded to a central expense management system.

•Leverage Bank/Credit Card Feeds: While not a substitute for receipts, automated bank and credit card feeds can provide a record of transactions. In cases of lost receipts, these can serve as a backup, though additional documentation may be required for tax purposes.

•Educate Employees: Provide clear training on the importance of receipts for tax compliance and company policy. Emphasize that a lost receipt can mean a lost deduction for the business.

5.2 Incorrect Categorization

Misclassifying expenses can lead to inaccurate financial reporting, skewed budgets, and potential issues during tax audits. This often happens due to a lack of clarity in expense categories or insufficient training.

How to overcome:

•Clear Category Definitions: Provide employees with a comprehensive list of expense categories and clear definitions for each. This can be part of your expense policy or a separate guide.

•Training and Examples: Conduct regular training sessions for employees on proper expense categorization, using real-world examples relevant to your business operations.

•Automated Categorization with AI: As discussed in Section 4.5, AI-powered tools can significantly reduce manual categorization errors by learning from historical data and suggesting appropriate categories. This can be reviewed and corrected by a human, further improving the AI's accuracy over time.

•Regular Review and Audit: Implement a process where expense reports are reviewed by a manager or finance team member before approval. This provides an opportunity to catch and correct miscategorizations.

5.3 Time Consumption

Manual expense tracking can be incredibly time-consuming, diverting valuable resources from core business activities. This is a common complaint from both employees submitting expenses and finance teams processing them.

How to overcome:

•Embrace Automation: This is the most effective strategy. Automate as much of the expense tracking process as possible, from receipt capture to data entry and report generation. The less manual intervention required, the more time saved.

•Integrate Systems: Ensure your expense tracking system integrates seamlessly with your accounting software, payroll, and other relevant business tools. This eliminates redundant data entry and improves data flow.

•Regular, Small Efforts: Instead of letting expenses pile up, encourage daily or weekly recording. Small, consistent efforts are less daunting and more efficient than large, infrequent bursts of activity.

•Centralized System: Use a single, centralized system for all expense tracking. This avoids data silos and ensures all financial information is easily accessible.

By proactively addressing these common challenges, businesses can build a more resilient, accurate, and efficient expense tracking system that supports financial health and strategic growth.

Conclusion: Mastering Your Business Finances

Effective business expense tracking is far more than a mere administrative task; it is a strategic imperative for any organization aiming for sustainable growth and financial stability. From ensuring tax compliance and maximizing deductions to providing invaluable insights for informed decision-making and precise budgeting, the benefits of a well-managed expense system are profound.

We've explored the fundamental principles, the essential steps to set up your system, the diverse array of tools available—from simple spreadsheets to sophisticated AI-powered platforms like Finni AI—and critical best practices that elevate your tracking from basic record-keeping to a source of strategic intelligence. We've also addressed common challenges, offering practical solutions to overcome obstacles like lost receipts, incorrect categorization, and the perennial issue of time consumption.

In an increasingly data-driven business landscape, leveraging technology, particularly AI, can transform expense tracking from a reactive chore into a proactive engine for financial optimization. By embracing automation, maintaining meticulous records, and fostering a culture of financial discipline, businesses can gain unparalleled clarity into their spending patterns. This clarity empowers leaders to identify inefficiencies, capitalize on savings opportunities, and allocate resources with precision, ultimately driving profitability and long-term success.

Remember, the journey to mastering your business finances is continuous. Regular review, adaptation to new technologies, and a commitment to best practices will ensure your expense tracking system remains a powerful asset, guiding your business towards a prosperous future. Start implementing these strategies today, and unlock the full potential of your financial data.

References

[1] Internal Revenue Service. (n.d.). Publication 334, Tax Guide for Small Business. Retrieved from https://www.irs.gov/publications/p334 [2] Internal Revenue Service. (n.d.). Deducting Business Expenses. Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/deducting-business-expenses [3] Internal Revenue Service. (n.d.). Recordkeeping. Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/recordkeeping